Best ETFs to Buy in 2025:

Your Guide to Smart Investing

Exchange-traded funds (ETFs) have become a popular choice for investors looking to diversify their portfolios while maintaining simplicity and cost-efficiency. But with 2025 introducing new economic trends and market dynamics, the question isn’t whether to invest in ETFs — it’s which ETFs should you invest in?

This guide breaks down everything you need to know about selecting the best ETFs in 2025, offering detailed insights into the current market landscape, top-performing funds, and practical tips that even seasoned financial planners can appreciate.

What are ETFs and Why Are They Popular?

If you’re new to the concept, ETFs are investment funds traded on stock exchanges, much like individual stocks. They typically hold a collection of assets such as stocks, bonds, or commodities, making them an easy way to achieve portfolio diversification.

Why investors love ETFs:

- Affordability: Lower expense ratios than actively managed mutual funds.

- Liquidity: Easy to trade throughout the day, unlike mutual funds.

- Flexibility: Wide variety of options ranging from sector-specific to global markets.

- Diversification: Instant exposure to multiple assets within a single fund.

Their accessibility and versatility make ETFs a staple for everyone, from retail investors to financial advisors.

2025 Market Landscape: What Influences ETF Investments Today?

Before narrowing down the best ETFs to buy in 2025, it’s essential to understand the current economic playing field. By factoring in these trends, investors can make more informed decisions.

Key Market Trends in 2025

- Sustained Growth in AI and Tech

The innovations in artificial intelligence, robotics, and cloud computing have reshaped industries. Demand for technology solutions drives investments in tech-heavy ETFs.

- Green Energy and Sustainability Boom

With intensifying global attention on ESG (Environmental, Social, Governance) criteria, clean energy and sustainability-focused ETFs are grabbing headlines and capital.

- Inflation and Interest Rates

Persistent inflation has brought fixed-income ETFs and inflation-protected securities into focus. Meanwhile, central banks are using interest rate adjustments to stabilize markets.

- Global Supply Chain Recovery

A post-pandemic recovery has boosted international trade and emerging-market ETFs.

Choosing the Best ETFs in 2025

Investors should take a methodical approach to find Best ETFs that align with their goals. Here are important criteria to keep in mind.

1. Look at Expense Ratios

Expense ratios indicate what percentage of your investment goes toward managing the fund. Ideally, aim for Best ETFs with an expense ratio lower than 0.50%, as high costs erode gains.

2. Examine Historical Performance

While past performance doesn’t guarantee future success, it can indicate management effectiveness and resilience through market fluctuations.

3. Check Sector Trends

Diversification is key, but it’s wise to also align investments with sectors showing strong growth potential — whether it’s tech innovation, healthcare advancements, or renewable energy projects.

4. Consider Your Risk Tolerance

A high-growth ETF may seem enticing, but assess how much risk you’re comfortable with. Some funds offer steady, slower growth while others focus on high-risk, high-reward opportunities.

The Top ETFs to Buy in 2025

Below are expert picks for ETFs that are poised to perform well in 2025. Each fund listed offers something unique to investors.

1. Vanguard Information Technology ETF (VGT)

Focus: Tech sector giants like Apple, Microsoft, and NVIDIA.

Why Invest: With AI and tech shaping the future, VGT offers unparalleled exposure to top-performing companies driving the digital economy.

Expense Ratio: 0.10%

Growth Potential: High, particularly as companies adopt emerging technologies.

2. iShares MSCI ACWI Low Carbon Target ETF (CRBN)

Focus: Sustainability and low-carbon companies across global markets.

Why Invest: Capitalize on the rising demand for environmentally conscious investments.

Expense Ratio: 0.20%

Growth Potential: Medium-High, supported by governmental ESG initiatives.

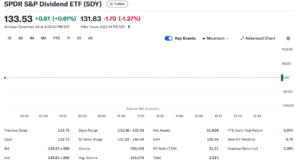

3. SPDR S&P Dividend ETF (SDY)

Focus: High-dividend-yielding stocks within the S&P 1500 Index.

Why Invest: This ETF appeals to investors seeking steady income during inflationary periods.

Expense Ratio: 0.35%

Growth Potential: Medium, with reliable returns driven by dividends.

4. Vanguard FTSE Emerging Markets ETF (VWO)

Focus: Emerging markets like China, India, and Brazil.

Why Invest: Post-pandemic recovery and rapid industrialization in emerging economies offer substantial growth opportunities.

Expense Ratio: 0.08%

Growth Potential: High, albeit with moderate risk.

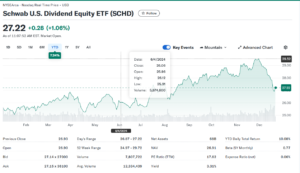

5. Schwab U.S. REIT ETF (SCHH)

Focus: Real estate investment trusts (REITs) in the U.S. market.

Why Invest: Rising interest in real estate due to inflation makes SCHH attractive for portfolio diversification.

Expense Ratio: 0.07%

Growth Potential: Moderate, with consistent real estate returns.

How to Incorporate ETFs Into Your Portfolio

ETFs work best when aligned with a clear investment strategy. Whether you’re starting fresh or optimizing your existing portfolio, follow these tips for success.

1. Define Your Financial Goals

Are you saving for retirement, looking for short-term growth, or generating passive income? Defining your goals will guide your ETF selections.

2. Diversify Across Sectors

Avoid overloading on one sector. A combination of tech, real estate, and sustainable energy ETFs balances risk and increases flexibility.

3. Monitor Your Investments

Markets evolve, and so should your portfolio. Regularly review ETF performance to ensure it aligns with your expectations.

4. Reinvest Your Dividends

If you’re invested in funds that pay dividends, reinvesting them could compound your returns over time.

5. Consider Professional Advice

Financial planners can provide tailored strategies based on your unique needs and risk tolerance.

Build a Future-Proof Portfolio Today

Best ETFs continue to shine as a practical, cost-effective way to diversify investments while staying aligned with emerging trends. What sets 2025 apart is the abundance of sector-focused options, from technology and sustainability to real estate, many of which are primed for long-term growth.

Whether you’re a seasoned investor or just stepping into the market, making strategic ETF choices could be the key to securing consistent returns. Do your research, define your goals, and take advantage of the low expense ratios and diversification options that ETFs offer.

If you’re ready to explore these opportunities, start by integrating one or more of the funds mentioned above into your portfolio—or consult with a professional who can tailor a plan specific to your needs.

Final Thoughts on ETF Investing in 2025

The year 2025 offers a wealth of opportunities for investors looking to make strategic and forward-thinking decisions with Best ETFs. By focusing on trending sectors, keeping an eye on expense ratios, and understanding your own financial goals and risk tolerance, you can build a resilient portfolio designed for long-term success.

Remember that while Best ETFs provide flexibility and diversification, they still require thoughtful consideration and due diligence. Market conditions and global events can impact performance, so it’s essential to stay informed and adaptable. Whether you’re prioritizing growth through tech-focused funds or seeking stability in dividend-paying options, there’s a Best ETFs that aligns with your investment vision.

With the right mindset and planning, ETFs can be a powerful tool in helping you achieve financial milestones, secure passive income, and capitalize on emerging trends. Now is the time to educate yourself, take calculated risks, and position your portfolio for a prosperous future. Happy investing!

FAQs About ETF Investing

1. What Are ETFs?

Exchange-traded funds (ETFs) are investment funds that pool capital from multiple investors to track the performance of an index, sector, commodity, or other assets. Unlike mutual funds, ETFs trade on stock exchanges, allowing investors to buy or sell shares throughout the trading day at market prices.

2. Are ETFs a Good Investment Option for Beginners?

Yes, ETFs are often considered ideal for beginners due to their diversification, low expense ratios, and accessibility. They simplify the process of investing in multiple securities, spreading risk across a portfolio without requiring significant expertise.

3. How Do Best ETFs Compare to Individual Stocks?

ETFs provide diversification by allocating investments across a range of assets, which helps mitigate risk. Individual stocks, on the other hand, concentrate investments into a single company, which could lead to higher risk—though with the potential for greater rewards if the stock performs well.

4. What Are Common Risks Associated with Best ETFs?

While ETFs offer diversification, they are not risk-free. Risks include market volatility, sector-specific downturns, or economic pressures impacting the overall market. Additionally, some niche ETFs may be exposed to high levels of risk due to limited diversification.

5. How Should I Choose an Best ETFs?

Consider factors like your financial goals, risk tolerance, expense ratio, and an ETF’s historical performance. Align your choice with sectors or trends you believe will perform well, whether focused on technology, sustainability, or dividends.

6. Do Best ETFs Pay Dividends?

Yes, many ETFs distribute dividends, depending on the underlying assets they invest in. Dividend ETFs, in particular, are designed to provide steady income by focusing on high-dividend-yielding stocks.

Key Takeaways

ETF investing in 2025 provides unparalleled opportunities for achieving financial goals while navigating a dynamic market landscape. Whether you’re pursuing growth, stability, or passive income, ETFs remain one of the most versatile tools in modern investing. By staying informed, defining a strategy, and aligning your choices with market trends, you can build a portfolio tailored for long-term success. Consistent review, discipline, and adaptability will ensure you reap the rewards of this diversified investment approach.

7. How Can I Monitor My ETF Investments?

Monitoring your ETF investments is an essential part of maintaining a successful portfolio. Begin by reviewing your holdings periodically to ensure they align with your financial goals and risk tolerance. Utilize tools like online portfolio trackers or mobile investment apps that provide real-time updates on performance and market trends. Additionally, stay informed about broader economic conditions and any regulatory changes that might impact your ETFs. Regularly revisiting your allocation strategy can help you remain agile and make informed adjustments when needed, ensuring that your investments remain on track toward achieving long-term success.

8. What Tax Implications Should I Consider With Best ETFs?

ETFs are generally considered tax-efficient investments due to their unique structure and trading mechanism. Unlike mutual funds, ETFs often minimize capital gains distributions because trades occur between investors on an exchange rather than directly with the fund. However, if you sell an ETF at a profit, you may be subject to capital gains taxes. Additionally, dividends distributed by ETFs may be taxed either as qualified or non-qualified, depending on the underlying assets and your holding period. It’s essential to consult with a tax advisor to ensure you understand how your ETF investments will affect your tax liability and to strategize any potential tax-loss harvesting opportunities.

9. What Are Some Popular Best ETFs Strategies?

Investors can leverage various strategies to maximize returns and manage risk with ETFs. Some common approaches include sector rotation, where capital is shifted into sectors expected to perform well in current market cycles, and dollar-cost averaging, a method of investing a fixed amount into ETFs at regular intervals to reduce the impact of market volatility. Another popular strategy is pairing growth-oriented ETFs with income-focused ones to balance long-term growth potential with steady cash flow. Additionally, thematic investing—focusing on trends like clean energy, artificial intelligence, or e-commerce—allows investors to tap into emerging industries while diversifying risk.

Final Words of Caution

While ETFs are a powerful investment tool, they are not a one-size-fits-all solution. Each investor’s circumstances, goals, and risk tolerance are unique, and it’s crucial to approach ETF investing with a clear strategy supported by thorough research. Be wary of overly complex or niche ETFs, as these may carry hidden risks or fees. Remember, past performance is not always indicative of future results, so stay informed and continually review your portfolio. With careful planning, adaptability, and discipline, ETFs can play a vital role in helping you achieve your financial objectives.

Other Usefull Articles :

10 Best State Farm Quantum Computing Jobs & Careers in Data Analysis